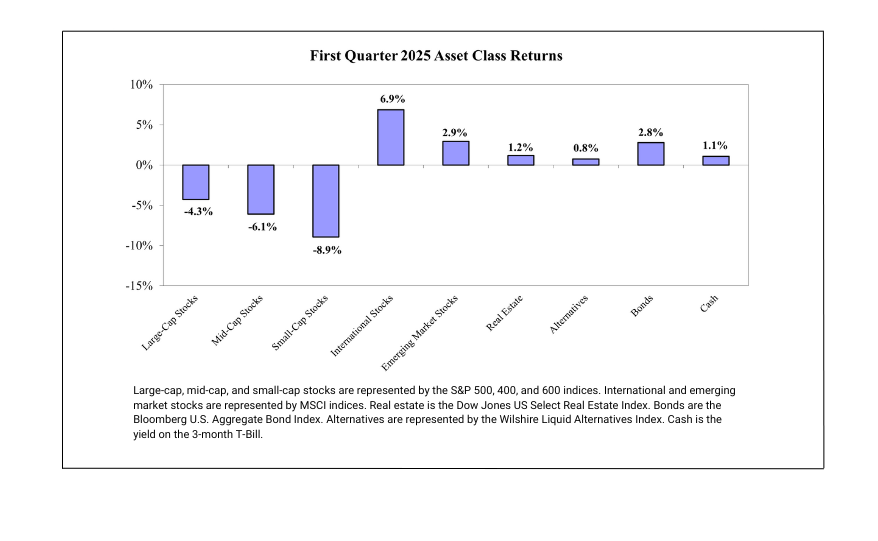

The first quarter of 2025 featured uncertainty and volatility for U.S. stocks. The S&P 500 entered correction territory by falling slightly over 10% from its record high price in February. For the full quarter, the index fell 4.3%. Small-cap stocks declined even more, as they were down 8.9%. However, international and emerging market stocks each delivered positive performance, generating returns of 6.9% and 2.9%, respectively. Bonds also had solid returns for the quarter, rising 2.8%, while alternatives continued to perform exceptionally well.

CHANGE IN MARKET LEADERSHIP AMONG STOCKS

Over the last few years, mega-cap growth stocks have led returns. The “Magnificent 7” stocks (Apple, Amazon, Alphabet, Meta Platforms, Microsoft, NVIDIA, and Tesla) together contributed over half of the S&P 500’s return in both 2023 and 2024. This reversed in the first quarter of 2025 as these seven stocks lost an average of 15.7%. If you had excluded these stocks from the index, the S&P 500 would have been slightly positive this quarter, showing the risks of an index with such a high percentage of holdings in just a few stocks. Along the same lines, technology stocks in general were a drag on the index. Tech stocks were the second worst performing sector for the quarter, down 11%. This sector currently makes up over 30% of the S&P 500 (more than double the next largest sector by index weight) so the index is highly influenced by the performance of tech. Meanwhile, energy stocks led large-cap returns, gaining 10%, but their weighting of less than 4% of the S&P 500 meant its contribution to the index’s returns was minimal.

This market environment in the first quarter was quite favorable for U.S. factor strategies. Large-cap low volatility and value stocks performed relatively well, delivering modest single-digit returns. This is partially because they are underweight the tech sector relative to the S&P 500. Momentum and quality stocks posted negative returns but still outperformed the broader index.

While the U.S. stock market in general was subpar for the quarter, international and emerging market stocks held up well. Developed international stocks were up 6.9% for the quarter, outperforming U.S. stocks by 11.1%. This was quite the reversal given how U.S. stocks have generally outperformed international stocks consistently over the past 15 years. International stocks have not outperformed U.S. stocks by this large of a margin in a single quarter since the second quarter of 2002. Emerging market stocks were also positive. The declining value of the U.S. dollar throughout the quarter helped drive returns. While future returns are impossible to predict, international stock valuations are still much more attractively priced than the broad U.S. stock market, which bodes well for international stocks going forward.

OUTSIDE OF STOCKS

Bonds returned a solid 2.8% as measured by the aggregate bond index. The asset class benefited from a decline in medium and longer-term yields, as the 10-year Treasury yield fell by 35 basis points from the start of the year. Shorter-term rates showed little change. The drop in longer-term interest rates caused short-duration bonds to slightly underperform the aggregate bond market. Over the long term, short-duration bonds provide a safer and more reliable income stream by mitigating interest rate risk compared to longer-term bonds. While holding less volatile short-duration bonds has historically earned less than longer-term bonds, the risk-adjusted returns have historically been greater, and drawdowns have been significantly reduced. In short, the ride is much smoother with short-term bonds.

Alternative investments continued to add positive returns to the portfolio. The style premia strategy was the top-performing alts strategy in the first quarter, with a return of over 10%, adding to its three-year annualized return of 21%. Managed futures, a strategy that has held up very well historically during stock market downturns, managed to deliver a 4.3% return. Multi-strategy and alternative lending returns were modest but still positive, while catastrophe bond returns were muted, partly due to the damage caused by the Los Angeles wildfires. The performance for liquid alternatives in aggregate was strong, adding to the exceptional performance that they have produced over the past few years.

LOOKING AHEAD

Volatility in the stock market remains elevated going into the second quarter. Ongoing changes in tariff policy proposals have caused uncertainty for businesses, consumers, and investors. Regardless of the impact of these policies, our investment philosophy remains unchanged. While market turbulence can be uncomfortable, it is not uncommon. Having a diversified portfolio with exposure to factors for stocks, limited credit and duration risk for bonds, and uncorrelated alternative investment strategies have historically been quite successful at mitigating downside risk.

For more information about Armbruster Capital and our investment management philosophy, contact us via our website, email info@armbrustercapital.com, or call (585) 381-4180.